As robo-advisers and apps continue to spread their way across the wealth management field, human advisers have two somewhat paradoxical challenges: setting themselves apart from the technological offerings, while also adapting to incorporate new technology to remain relevant in the modern world.

As risk-profiling forms a cornerstone of the modern advice process, many new systems have been created to enhance this process and allow a more personalized experience. Some of the most innovative technology to enter wealth management is facial-recognition software to definitively define a client’s tolerance for risk.

Financial advisers find their niche in how they relate to their clients, taking the time to understand their needs in more depth than a multiple-choice survey on an app would be able to uncover. One of the most effective ways this is done is by tuning in to a client’s emotional reactions through their facial expressions in combination with the information they provide you through their own self-analysis.

Nonverbal communication

Michael Argyle, a pioneer of the social psychology field in 20th century Britain, hypothesized that while spoken language is generally used to communicate information about events external to the speakers, nonverbal communication (NVC) is used to establish and maintain interpersonal relationships. He used video tapes to analyse subjects interacting, and found that nonverbal cues had 4.3 times the effect of verbal cues, the most powerful being body posture communicating a sense of superior status.

Argyle established the five primary functions of nonverbal communication in his 1975 book Bodily Communication: expressing emotions, expressing interpersonal attitudes, to manage cues of interaction between speakers and listeners during speech, self-presentation of one’s personality, and rituals (i.e. greetings). While some aspects of NVC is made up of conscious movements, much of the time one’s facial expressions and postures are occurring without their awareness—especially those that occur on a smaller scale. These ‘micro-expressions’ are often are unrecognized by both parties, happening unconsciously and quickly dissipating, despite the great amount of information they hold.

Microexpressions

Without training, when looking at another person’s face, most people can read about 20% of the emotional content within their features. Dr. Paul Ekman, American psychologist best known for his work in facial expressions, described the vital and often missed ‘micro-expressions’ which happen subtly and subconsciously but show the true emotion that a person is experiencing. While all people are different, Dr. Ekman spent time working with people in isolated societies and was able to provide very strong evidence that human facial expressions are in fact universal.

Modern advisers don’t just need to understand finances; they need to understand people. More and more, the process of advice involves the reading of relationships, expressions, and worries as much as the reading of portfolios. While these micro-expressions are often undetectable to other people, facial recognition software is able to identify them and gain access to the powerful information they hold.

Facial Recognition Technology

In 1978, Dr. Ekman, W. Friesan, and J. Hagar developed the Facial Action Coding System for measuring facial movement, and facial recognition technology has advanced incredibly since then.

nViso, a Swiss artificial intelligence company, uses facial recognition to help both advisers and customers better understand a customer’s feelings, needs, and comfort levels with risk and finance. The technology company has found that many clients are unaware of their deep-set relationships and fears around finance. Their products use multiple methods to help both clients and their advisers deduce underlying values, fears, and desires through artificial intelligence, scanning subtle changes in a client’s features, and specific routes of questioning.

Nviso’s programs can read around 80%, and by watching someone’s face through their webcam as they watch a video, they can feed back information about what kind of thinker that person is, how they relate to the world, and what their priorities are. Oftentimes, this is information that even the client themselves may have been unaware of consciously.

These observations of a client’s internal beliefs and values will show both the adviser and client the ways those beliefs deviate from what the client has expressed in words. This opens many paths for conversation between adviser and client and helps an adviser to ask new questions from different perspectives. It also creates an opening for advisers to bring up topics that they would not normally discuss or are of a sensitive nature, if the software makes it clear that those topics are very important for that client.

My Face, Recognized

I tried out nViso’s fintech ‘Insights ADVISE’ AI system this week, which uses the client’s webcam to scan their face while they watch a video about a series of issues they may care about. Their theory is that if people better understand how they feel about money, they can use it better.

The AI analyzes subtle movement in the 43 muscles of the face while the client watches a video and maps it to Dr. Ekman’s universal facial expressions in order to determine the viewer’s emotions.

Before watching the video, I was asked to rank how important I thought six different issues were, from data safety and security to oncology to waste and water management. I then used a sliding scale to denote how much I agreed with certain statements about myself, such as ‘do you find organization important?’ like a standard personality test.

Then I watched a video and tried to keep my face in the little box (make sure you’re in good lighting if you try it). The video went through the six topics I’d ranked, while generic scenes relating to the issue played and an educational-film style voice over gave a short description of the issue. There was nice calming music involved.

A report came through in just a few seconds. It told me if I was a past, present, or future thinker (or in my case, exactly in the middle of all three) and what traits that connected with. The report then showed me which topics I had chosen as most important as opposed to what I had the strongest emotional reaction to. This was also compared to how my ‘peers’ ranked the topics– Gen Z was not an option, so I pretended to be a Millennial.

It went on to give me more information about how my thinking style works and what type of market and products I’d prefer based on it. The description for my thinking style was similar to my Myers-Briggs type description (mediator type, moderate, good fashion sense), which seems like a good sign regarding the AI’s accuracy or perhaps my own accuracy in self-analysis.

And of course, it recommended me an nViso financial adviser that I could contact.

Does understanding my own thinking patterns and emotions around money help me (and/or my adviser) make better investment decisions? Apparently I care about retirement planning, which I was not aware of because I’m 22 and American and a dancer by trade so I’ll probably never actually be able to retire and just work until I die. But knowing that future planning and saving is important to me can certainly help guide the investment decisions I make. Knowing that I am most comfortable with a moderate approach combining innovation with well-researched systems can definitely help my adviser narrow down which products are right for me.

It’s very easy to see how handing this information to an adviser would both jump-start and personalize the advice process. As an investor, I’ll be able to make a more informed choice when I’m also informed on my own biases. As an adviser, knowing what types of products the client will be most comfortable with and what their priorities are in their investments is central to serving the client well.

Impact of Emotion

While financial decisions are generally considered logic-based choices, the truth is that many of those choices are driven by a client’s emotion—though they often do not know it. nViso’s goal is to give both parties the information they need; to lead the client to understand better what they need from the adviser, and to show the adviser what’s truly important to their client.

Emotion is also reported to be the most important component of trust in financial advisory relationships. Vanguard has identified a +3% margin opportunity, of which half comes from better understanding client behaviour and emotions around finance.

A good modern adviser doesn’t just tell a client what they should do with their money—they work to change a client’s habits and understanding of investment in ways that will benefit that client in the future. And knowing how a client actually feels about their finances is essential to the process of helping them understand how to make better choices in the future.

Identif-eye Chart

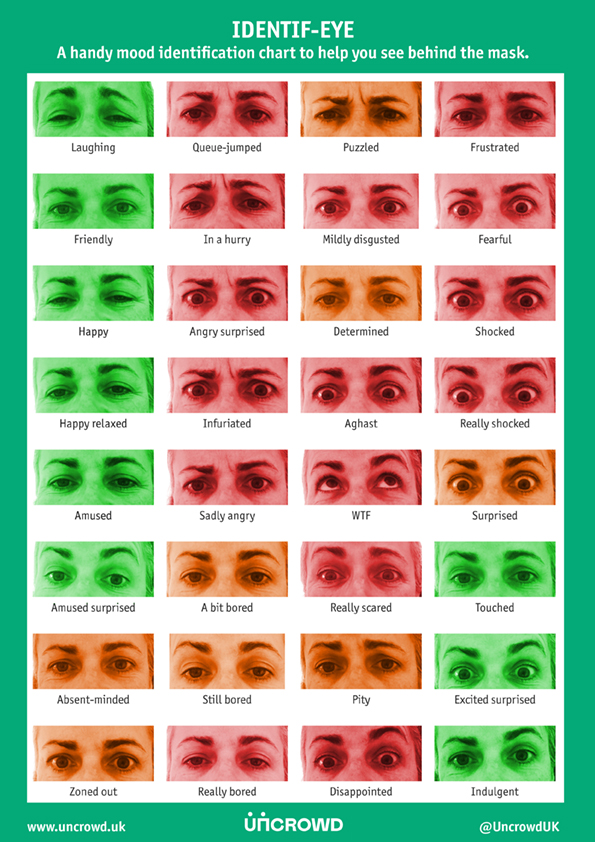

For now, most adviser-client meetings happen through video call, but hopefully face-to-face meetings will occur again soon— most likely with masks on. If reading a person’s expression is so central to understanding what they’re thinking, how can advisers still optimally help their clients by looking only at their eyes?

Uncrowd, a London-based start-up that helps retailers better understand their customer service and experience, has created the ‘Identif-eye’ guide to help discern what a customer is feeling through their eye-expression alone.

Richard Hammond from Uncrowd says: “Good retailers can read their customers like a book, but if their mouths are hidden behind masks, it’s a bit harder to work out what they’re thinking and feeling. Our at-a-glance guide should help to check the mood of a customer.”

The chart below illustrates 32 key expressions that a client may make during an interaction, from zoned-out to determined to ‘WTF’. The chart’s style of pictures of people making an expression with the title of the shown expression underneath echoes some of the training materials from Dr. Ekman’s ‘Micro Expression Training Tools’. When less of the face is visible, it is more important to look for small differences in features that you may not usually pay attention to. Being able to recognize the particular way an eyebrow is slanting or the eyes widen could mean accessing important information about how your client feels.

By taking a few moments to study the guide below, you may find some useful patterns to bring to all your client meetings. Try practicing applying the patterns to different faces while you do your food shopping, and you’ll be ready to safely and effectively help your clients, no matter how much of their face you can see.